11

JulInternational Womens Day : Flat 30% off on live classes + 2 free self-paced courses - SCHEDULE CALL

Well, that’s a very interesting question to answer. But don’t worry I will help you figure it out in an interesting way. As a business analyst, this domain gives an insight into the world economy and thus you can understand what kind of exposure it brings for any business analyst role. Within the course of the period of time, a business analyst can also become a subject matter expert, if the domain knowledge is quite high. Finance domain has always seen challenges, ups, and downs. But we all know it's impossible to run the world without financial flow and that’s the reason this will always be an evergreen domain and BA’s can take advantage to analyze it each day.

This blog will help you to go through details of financial assets, financial services, and financial markets.

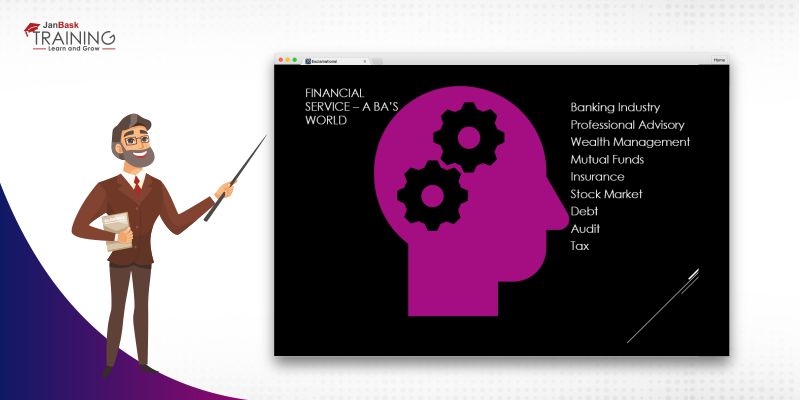

As a business analyst, there is always a sort of confusion involving what we refer to with the term Finance Domain as that determines the analysis. On the one hand, there is a feature called finance that is common to all business enterprises, in each and every industry and we have covered these finance methods below Functional Skills. On the different hand, there is a monetary offerings industry. Then we have a time period that refers to all financial institutions like Banking, Brokerage Houses, and Insurance, etc. Financial offerings are the economic offerings furnished by using the finance industry, which encompasses a broad range of companies that control money, consisting of credit score unions, banks, credit-card companies, insurance plan companies, accountancy companies, consumer-finance companies, stock brokerages, funding funds, person managers and some government-sponsored enterprises.

The business analysts visualize the finance domain as a range of functions, things to do and processes. It compasses financing functions, budgetary functions, threat and return management, money glide management, cash management, monetary management, danger and governance, and many more associated functions.

Let’s check out one more important theory which actually enhances the skill set of the business analysts. The time price of money is one of the most essential theories in finance. It states that a greenback nowadays is well worth extra than a greenback in the future. Many of the fundamental ideas in finance originate from micro and macroeconomic theories. One of the most imperative theories is the time cost of money, which in fact states that a dollar nowadays is worth more than a dollar in the future. As a BA, imagine if you are unable to figure it out this theory, would it not impact your job role.

Since individuals, businesses, and authorities entities all need funding to operate, the finance discipline includes three predominant sub-categories: private finance, company finance, and public (government) finance.

An economic asset is a liquid asset that gets its price from a contractual applicable or ownership claim. Cash, stocks, bonds, mutual funds, and bank deposits are all examples of monetary assets. Unlike land, property, commodities, or different tangible physical assets, monetary belongings do not always have inherent bodily really worth or even a bodily form. Rather, their cost reflects factors of furnish and demand in the market in which they trade, as nicely as the diploma of the threat they carry.

Read: What is Comparative Analysis: Importance, Examples and Tips

According to the International Financial Reporting Standards (IFRS), a monetary asset can be:

A business analyst needs to have a detailed picture of financial assets as it gives more clarity to the organization and boosts the intelligence level. Most possessions are sorted as both genuine, budgetary, or elusive. Genuine things are in essence property that draws their cost from materials or properties, for example, significant metals, land, real bequest, and wares like soybeans, wheat, oil, and iron.

Elusive resources are the valuable property that is never again substantial in nature. They incorporate licenses, trademarks, and mental property.

Money related property is in the middle of the distinctive two resources. Money related property may seem elusive—non-physical—with just the referred to cost on a bit of paper, for example, a dollar transfer or a posting on a PC screen. What that paper or rundown speaks to, however, is a presentation of responsibility for elements, similar to an open organization, or legally binding rights to installments— say, the premium income from a bond. Monetary things get their cost from an authoritative case on a basic resource.

The way any business analyst can measure financial assets is explained further -

The most vital accounting issue for economic assets includes how to record the values on the balance sheet. As a business analyst, if you are good at calculation and excel, you can do wonders in finance domain analysis. Considering all economic assets, there is no single dimension approach that is appropriate for all assets. When investments are rather small, the current market price is an applicable measure. However, if you analyze deeper, then any agency that owns a majority of shares in every other company, the market fee is not particularly relevant due to the fact the investor doesn’t intend to sell its shares.

Financial provider is a phase of monetary gadget that gives one kind of finance through a number of deposit instruments, financial merchandise, and services.

In monetary instruments analysis, business analysts come across cheques, bills, promissory notes, debt instruments, letters of credit, etc.

Read: Discovering the Underlying Competencies of Business Analyst

In economic products, analysts come across specific types of mutual funds. extending quite a number of sorts of investment opportunities. In addition, there are also merchandise such as deposit cards, debit cards, etc. Any business analyst needs to apply intelligence analysis methodology

Let’s understand the importance of financial services for business analysts -

A money related middle person is a substance that goes about as the delegate between two gatherings in a financial exchange, for example, a business bank, subsidizing bank, common reserve, or benefits support. Money related middle people offer various advantages to the normal purchaser, which incorporates wellbeing, liquidity, and economies of scale associated with banking and resource the board. Despite the fact that in specific territories, for example, contributing, propels in science take steps to put off the monetary mediator, disintermediation is a ton considerably less of a risk in various zones of account, including banking and protection.

At the point when a business analyst working in money related administrations works from the part of budgetary middle people, they have to remember these significant components to institutionalize their analysis -

Well keeping the details of intermediaries, financial business analysts always derive a working pattern which helps into a deeper analysis of the domain. But working pattern BA needs to understand the working pattern of the financial system.

A non-bank money related go-between doesn't currently acknowledge stores from the ordinary open. The middle person may moreover outfit figuring, renting, protection plan plans or diverse financial administrations. Numerous delegates participate in protection trades and utilize long haul plans for overseeing and developing their assets. The standard monetary dependability of a US of America may furthermore be demonstrated through the activities of monetary go-betweens and the blast of the money related contributions industry.

Monetary middle people pass dollars from parties with additional money to occasions requiring reserves. The method makes well-disposed markets and brings down the cost of leading business. For instance, a financial guide associates with clients through purchasing protection, stocks, bonds, land, and different resources. Banks associate borrowers and loan specialists with the guide of introducing capital from other monetary foundations and from the Federal Reserve. Insurance agencies gather premiums for arrangements and give inclusion benefits. Any reserve identified with annuity gets gathered in dollars in the interest of donors who thus convey the reimbursements to retired people.

Read: Understand The Background Of Business Analysis Documentation Now

A money related market is a market wherein individuals exchange financial protections and subsidiaries at low exchange costs. A hardly any protections additionally comprise of stipend and securities, and important metals.

The timespan "advertise" is from time to time utilized for what are all the more carefully traded enterprises that encourage the trade-in money related protections, e.g., a stock change or ware trade. Much purchasing and selling of stocks happens on a trade; despite everything, organization activities (merger, side project) are open-air trade, while any two gatherings of individuals, for anything reason, may also consent to elevate stock from one to the next other than the utilization of a trade.

Some money related markets are modest with barely any action, and others, similar to the New York Stock Exchange (NYSE), alter immense measures of dollars of protections day by day basis. The values (securities exchange) is a budgetary market that permits financial specialists to buy and advance portions of traded on an open market organization. The essential financial exchange is the spot where new issues of stocks, known as primer open decisions (IPOs), are sold. Any ensuing exchanging of stocks occurs in the optional market, where purchasers purchase and sell protections that they effectively claim. As a business expert in the event that you don't have a thought of money related markets, at that point the odds are that you are not investigating the market and your rivals.

The kinds of money related market which would you be able to be a fund business expert -

Conclusion

Any domain is very vast and it takes an immense amount of hard work to get deeper into it. But it's the role of a business analyst, who can do wonders for the organization as well as for their growth. This blog will give you the first level of domain knowledge which you would need as a BA to make a start. I hope you had a great learning experience with us.

Read: Top Business Analyst Interview Questions and Answers

Pinterest

Pinterest

Email

Email

A dynamic, highly professional, and a global online training course provider committed to propelling the next generation of technology learners with a whole new way of training experience.

Cyber Security

QA

Salesforce

Business Analyst

MS SQL Server

Data Science

DevOps

Hadoop

Python

Artificial Intelligence

Machine Learning

Tableau

Search Posts

Related Posts

All You Need to Know About Business Analyst Qualification

![]() 392.9k

392.9k

Business Analyst vs Financial Analyst

![]() 131.5k

131.5k

The Miracle Of CCBA - Certificate of Capability in Business Analysis

![]() 235k

235k

Business Analyst Tutorials For Beginners & Experienced: A Comprehensive Guide

![]() 4.7k

4.7k

What is the Truth Behind the Demand of Business Analysts in Canada?

![]() 8.3k

8.3k

Receive Latest Materials and Offers on Business Analyst Course

Interviews